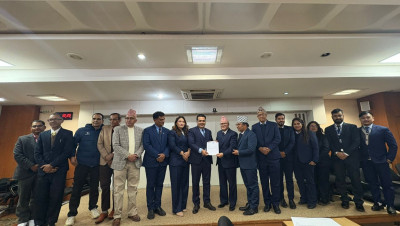

API Banking Platform 'RAPID' Launched, Offering All Banking Facilities to Corporate Clients on a Single Platform

-1763893375.jpg)

Kathmandu. Corporate clients will no longer have to face the hassle of switching between different platforms to check account balances, get statements, transfer funds, pay EMI, or manage salary payments.

Nepali technology company Gokyo Labs has launched an Open Banking concept-based API banking platform named 'RAPID' that allows all these services to be performed from a single location.

Previously, corporate clients had to use various banks and software platforms for these tasks, which consumed both time and resources.

Now, once banks and financial institutions integrate 'RAPID' into their systems, users can perform all banking tasks using a single platform from within their own software or ERP system.

In the initial phase, users of Tigg accounting software who have an account with Global IME Bank will be able to access RAPID's features. Users can link their bank account by going to 'Connect with API Banking'.

Ashutosh Shah, Business Head of Gokyo Labs, stated that RAPID will bring a significant transformation to the delivery of corporate banking services.

The new system will digitally integrate financial operations, substantially reducing the time, cost, and operational hassles for businesses.

"Initially, this facility has gone live with Global IME Bank. Now, we are quickly expanding our collaboration with other major banks and various software providers," Shah said.

Currently, the bank balance and bank statement facilities are live with Global IME Bank. The remaining features will also be available gradually.

Shah anticipates that with the expansion of RAPID, Nepal's API banking ecosystem will establish a new standard for integrated, smooth, and secure digital transactions.

To use the service, customers will only need to visit the bank once to fill out a form, similar to mobile banking.

After that, all tasks can be performed online. RAPID has also digitized the customer consent process, adding further ease and transparency.

In terms of security, the company reports that RAPID uses end-to-end encryption, multi-layer verification, and state-of-the-art security protocols. This will secure all types of transactions.

Furthermore, 'RAPID' aims to make the API banking concept accessible, providing equal access to small, medium, and large businesses.

The RAPID platform is expected to advance the Banking as a Service (BaaS) model and elevate the collaboration between banks, fintechs, and digital service providers to a new level.

-1763893376.jpg)

-1763893375.jpg)

Helicopter from Jumla lands in Salyan due to bad weather

January 30, 2026

Mahabir Pun's Appeal to Voters: Do Not Sell Your Vote for Money

January 30, 2026

Helicopter from Jumla lands in Salyan due to bad weather

January 30, 2026-1769761552.jpeg)

NRNA Must Rise Above Personal Interests: Foreign Secretary Rai

January 30, 2026-1769761552.jpeg)

-1769665496.jpeg)

-1769407418.jpeg)

-1769770966.jpeg)

-1769760538.jpg)